Health Excellence Plus is a Healthy Care Strategy offered exclusively by My Academy of Health Excellence.

- Priced at about half the cost of traditional health insurance,

- yet designed to comply with the ACA (Affordable Care Act – ie Obamacare).

- Keep your present Doctor and Save Thousands.

Join a Webinar or watch Yesterday’s

Join a Webinar or watch Yesterday’s

For a quick overview of Health Excellence Plus, click Seminar/Webinar image (above) then register an watch yesterdays Webinar or step through this Presentation. Please watch the videos and follow links for more information. If you’d like a more detailed understanding, skip the Presentation and begin at “Solving the Health Insurance cost Problem for America” below.

Solving the Health Insurance Cost Problem for America.

With the rising costs of health insurance, Americans are looking for a cost-effective and efficient way to provide financially for the medical needs of their own & their employees that also complies with the Affordable Care Act (ACA). Whatever the goals and motivation behind the law, the net result has been neither “Affordable” nor improved access to “Care.” Through a Healthy Care Strategy which combines 1- a proactive wellness program – My Academy of Health Excellence, 2- preventive health insurance – MEC Plus: Minimum Essential Coverage (that ensures that both employers and employees comply with the Affordable Care Act), 3- monetary benefits – HSA: Health Savings Account, 4- mitigation tools – Teladoc, Advocacy etc, and 5- an organized benevolence – Sedera Health: Medical Cost Sharing we help businesses to control their medical expenses and those of their employees.

The best way to take control of and reduce healthcare expenses is to become a self-pay patient (this is a term used to describe someone who chooses to pay for their treatment directly and elects to become a member of a group of like-minded, health-focused people, just like themselves, that agrees to share any costs they incur above an amount they can comfortably handle). Self-pay patients are wise and educated consumers of healthcare services and ask for discounts when they pay for and receive services from providers. Sedera Health (the medical cost sharing administrator) helps negotiate these discounts further for bills that exceed $500 when bills are submitted.

As an example of what self-pay patients can save on their health care costs, true self-pay patients generally pay approximately 6.06% of what they are billed by hospitals, according to an article by Kelly Gooch in the Hospital CFO Report dated March 2, 2017. Self-pay patients often save 1/3 to 1/2 on their doctor bills, as well. Such patients also strive to be healthy and live a healthy lifestyle.

The best way to CONTROL Your Medical COSTS is a Healthy Care STRATEGY, Not Health Insurance

1- The foundation of any Program designed to help CONTROL Medical COSTS should be to AVOID them, this is accomplished with a Wellness Program.

Currently, in the United States, eighty-six cents of every healthcare dollar spent is used to treat or manage chronic conditions. A full 80% of those conditions are completely preventable through awareness, education and lifestyle modification. Participation in our wellness program provides you with the tools and resources needed to identify and mitigate your potential health risks. If we can collectively eliminate the need for preventable procedures and treatments, the costs for everyone are reduced. In a Medical Cost Sharing environment, where member’s pay each other’s expenses, it is incumbent on each of us to achieve the highest level of health and wellness possible.

Everyone is unique and different. By participating in this program and engaging with your Wellness Coordinator, we can help you identify the particular area of health and wellness most important to you and customize a program to help reach your goals.

We believe that the # 1 Reason people don’t reach their health goals is the everyday interruptions of Life.

Our Wellness Coordinators use a multi-touch outreach program to engage members with

- The MyAHE Secure Members Communication Portal,

- Secure Audio and Video Connections,

- Direct Mail, Email Campaigns, Text Messaging,

- “Health Excellence Newsletter”

- Webinars and Seminars

- and the MyAHE Mobile Application.

These efforts serve to remind members of their commitments and to keep them engaged

2- Because you can’t AVOID all Medical COSTS, you’ll need to PREVENT those that you can with a MEC Plus (Minimum Essential Coverage).

A MEC Plus – Minimum Essential Coverage provides coverage for 64 preventive services such as Annual Physicals, Mammograms, Colonoscopies, etc. at no additional cost to you. This solution provides an alternative that satisfies the federal statute without compromising the moral and spiritual beliefs of members. To comply with the federal law, Health Excellence Plus establishes a qualifying self-insurance plan known as Minimum Essential Coverage.

a MEC Plus Plan is a self-funded PPO administered by a third party administrator. There’s no charge for in-network preventive services determined by the U.S. Preventive Services Task Force as required to be covered by ACA (Obamacare) plans. The member pays 130% of Medicare for preventive services provided by out-of-network providers.

The MEC Plus utilizes the PHCS network in all states except California, where it uses the Network By Design network. These are large networks. PPO network providers change frequently, so it’s best to call 800-922-4362 (for PHCS) or 209-229-8537 (for Network By Design) to confirm or find providers. If you call, mention MPowering Benefits LLC and that you are a current or prospective member of Health Excellence Plus.

Preventive services are one of Obamacare’s Essential Health Benefits. Preventive coverage provided under a self-funded plan meets the federal government’s requirements for Minimum Essential Coverage for a small group plan (generally under 50 full-time employees). Accordingly, the plan satisfies the Employer Shared Responsibility Mandate for Minimum Essential Coverage as well as the Individual Mandate and therefore avoids having any tax penalties for either the individual or the employer for not participating in an Affordable Care Act plan.

Preventive Minimum Essential Coverage is a layer of self-funded insurance that covers a list of over 60 preventive and wellness care services (these services are adjusted annually and additional services have been added for 2018).

There are specific services for women, children, and all adults. The list of services includes yearly wellness checks, flu shots, vaccines, mammograms, colonoscopies, and many other preventive services (see the complete list at healthcare.gov.)

3- Because you can’t AVOID or PREVENT all your Medical COSTS, you’ll need to MANAGE some of them with an HSA-Health Savings Account.

HSA’s (Health Savings Accounts) are for the smaller bills associated with your health care needs (as well as for other medical services like dental and vision care and services that are either limited or excluded from sharing under the Select Membership Guidelines). Your HSA is a tax-advantaged savings account where you can contribute up to $3,400 (individual) or $6,750 (family) for 2017 (these limits increase to $3,450 and $6,900 for 2018) and take a tax deduction for the amount of your contribution.

Individuals age 55 or over (limit of one per HSA) can also make additional “catch-up” contributions up to $1,000 per year. Contributions are tax deductible.

Funds in an HSA account can be used toward paying any qualified medical expense as defined by the IRS. Examples include prescription and some over-the-counter medications, doctors’ visits, urgent care visits, glasses and vision care, and dental work. Cosmetic-type services are excluded in most cases. Complete details of what are considered qualified medical expenses are contained in IRS Publication 502.

You reduce your expenses by the percentage of your tax bracket when you pay for a service from an HSA. For example, if you’re in a 33% federal tax bracket, you’ll reduce your expenses for a qualifying medical expense by 33% when you pay for that expense from your HSA. In almost all states that have state income taxes, you can also deduct the HSA contribution from your state taxes and additionally reduce your expenses by the % of your state tax bracket as well.

All members should establish HSA’s to help pay for qualified medical expenses that are not Large Needs and to facilitate payment of their shareable medical expenses (see the description of Contain, below).

A tax-advantaged savings account that they can use to pay for eligible medical expenses as well as deductibles, co-insurance, prescriptions, vision expenses, dental care, alternative services and more. Unused funds that will roll over year to year. There’s no “use it or lose it” penalty. The potential to build more savings through investing. Members can choose from a variety of self-directed investment options with no minimum balance required. After age 65, funds can be withdrawn for any purpose without penalty but may be subject to income tax if not used for IRS-qualified medical expenses.

4- Because you can’t AVOID, PREVENT or MANAGE all your Medical COSTS, you’ll need to MITIGATE some of them with Telemedicine, Advocacy, and other No Cost Tools.

Using modern technology for non-urgent medical needs, such as a rash or fever, instead of rushing to the doctor’s office, urgent care or the ER saves thousands. Members have access to a dedicated Member Advisor through the medical cost sharing provider. Your assigned Member Advisor helps you navigate confusing aspects of your health care and can be utilized for a variety of healthcare-related questions, surgery cost savings, counseling, medical bill negotiation, appointment scheduling, reduced prescription costs, and physician searches.

![]() The program gives you access to the world’s best doctors. Through the 2nd. MD program, top medical specialists are available to you. 2nd.MD’s specialists are leading groundbreaking researchers and teach the most innovative techniques from the top medical institutions in the world, e.g. Mayo Clinic, Cleveland Clinic, and Johns Hopkins. They’re the “doctors’ doctors.

The program gives you access to the world’s best doctors. Through the 2nd. MD program, top medical specialists are available to you. 2nd.MD’s specialists are leading groundbreaking researchers and teach the most innovative techniques from the top medical institutions in the world, e.g. Mayo Clinic, Cleveland Clinic, and Johns Hopkins. They’re the “doctors’ doctors.

If you face (1) a new diagnosis, (2) a possible surgery, (03) a change in medication, or (4) a chronic illness, even including one currently excluded from sharing because it is a pre-existing condition and want to discuss your options with a top expert on your condition, 2nd.MD is here for you. You’ll have access to more than 300 nationally recognized, board-certified medical specialists that cover more than 120 sub-specialties. These world-renowned physicians are available for consult via video conferencing or telephone from virtually anywhere in the world within about 3 days, providing program members the peace of mind that they want and deserve.

The program’s experience with 2nd. MD is that 1/3 of planned surgeries are canceled; that treatment plans are improved 70% of the time; and that the average savings/consultation are $3,000.

If a member receives treatment in accordance with the second opinion, his or her Initial Unshareable Amount for medical cost sharing (see the Contain section of this webpage) will be reduced by 50%.

Sedera (the medical cost sharing administrator) requires members to use the 2nd MD program prior to undergoing elective surgeries and suggests that members who have any of the four situations described above (including members with significant pre-existing conditions) utilize this no cost service.

If the member disagrees with the second opinion, s/he can request a third opinion and the opinion of two of the three doctors will be considered the second opinion.

Program members who don’t use 2nd MD in the case of an elective surgery will be penalized under medical cost sharing. Need sharing may be reduced up to 25% on bills over $500 for members who either refuse to utilize the 2nd MD program, intentionally skip the process, or who don’t follow the second opinion.

![]() Teladoc™ (Telemedicine) offers convenient access to board-certified physicians, dermatologists, and pediatricians 24 hours a day 7 days a week/365 days a year through a phone call. It allows members to talk to a doctor when they need it, without having to book an appointment or take time off from work to visit an office in person. Members can call as often as they wish and there is no cost for a consultation. Teladoc physicians can prescribe medications over the phone and can even video conference in most states. It’s not for everything, but great for the small stuff.

Teladoc™ (Telemedicine) offers convenient access to board-certified physicians, dermatologists, and pediatricians 24 hours a day 7 days a week/365 days a year through a phone call. It allows members to talk to a doctor when they need it, without having to book an appointment or take time off from work to visit an office in person. Members can call as often as they wish and there is no cost for a consultation. Teladoc physicians can prescribe medications over the phone and can even video conference in most states. It’s not for everything, but great for the small stuff.

Feeling ill is never convenient, especially in the middle of the night or while traveling. With Teladoc, the doctor is always in, day or night.

Examples of items that fall into this category: cold, sinus infection, and flu.

For emergencies call 911. Teladoc is not available in Arkansas.

5- Because you can’t AVOID, PREVENT, MANAGE or MITIGATE all your Medical COSTS, you’ll need to CONTAIN the rest with Medical Cost Sharing.

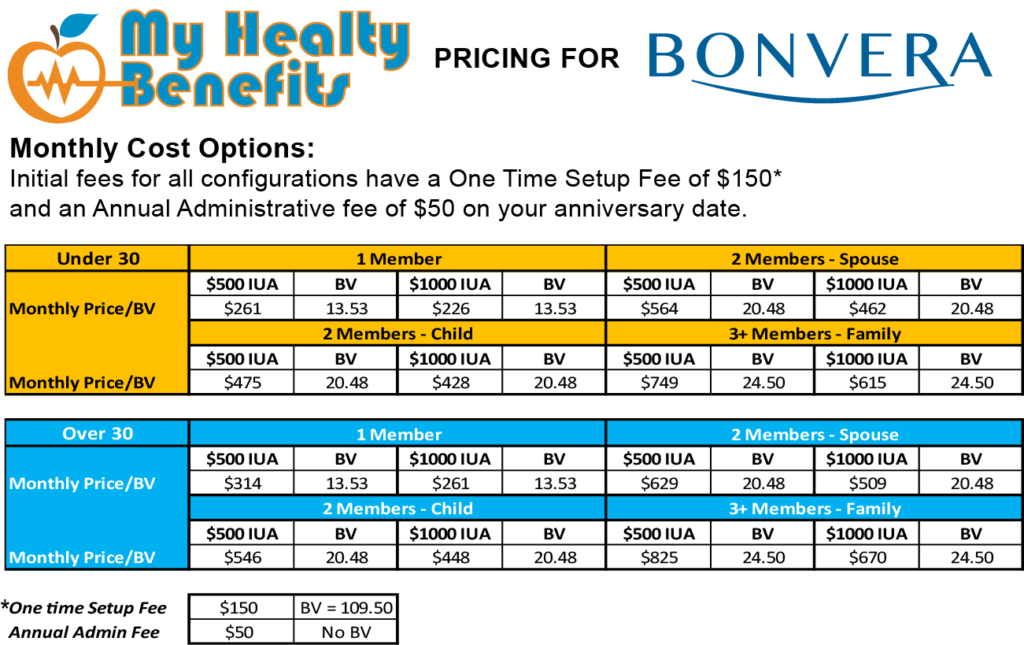

Medical Cost Sharing is a community of like-minded, health-focused members banded together to share each other’s medical costs above an amount they can comfortably afford. Sedera Health Sharing Organization, a self-pay Patient Platform complete with member services and Health Sharing for large needs with a choice of an unshared amount. ($500 or $1000 per incident)

Participating member households are required to abide by the Sedera Membership Guidelines, as set forth in this document. Memberships are not refused on the basis of the health status of individual members, although medical conditions that existed prior to membership may be limited or excluded from sharing. No one is denied membership based on prior medical conditions. However, any needs that do not qualify according to these Guidelines as shareable needs can still be made known to other members through our Special Needs Sharing division (See Section 5.A.). In this way, members with non-shareable needs still have the opportunity to receive help from other members.

How Much Does It Cost? The Health Excellence – Plus solution combines everything you’ll need to become a successful ‘Free-Market Patient’ who is MPowered with health cost sharing:

For more information call 918-921-1941

or continue to “What is Medical Cost Sharing?”